Tax havens play an important role in the globalization of capital markets but also threaten their stability and structure. What are the properties of tax havens? When began tax evasion? What do fiscal paradises offer? How profit private persons, companies and the organized crime from tax havens?

There are many names for the same areas: offshore havens, fiscal paradises or tax havens.

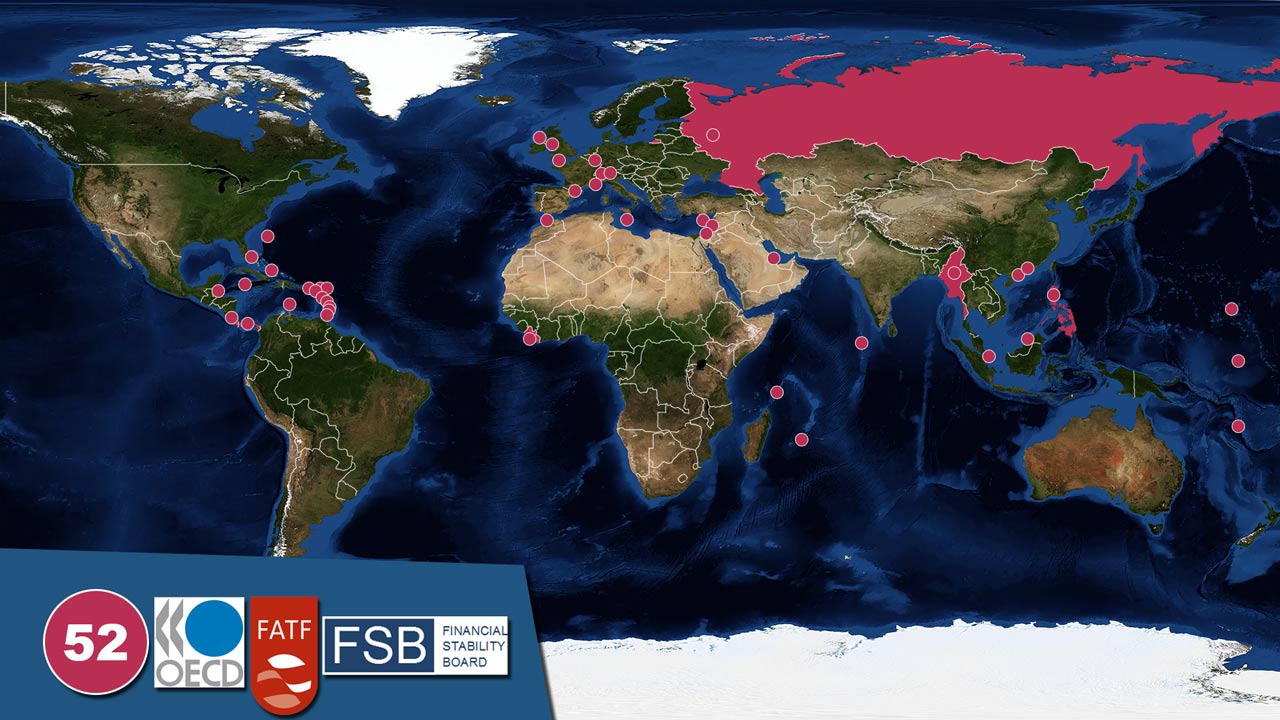

In a first list from the year 2000 existed 52 areas and countries, which comply with the definition of tax havens. 33 of them were part of the United Nations, within them Russia. According to this was every sixth of the 193 UN member states considered as a fiscal paradise. And from 19 dependent areas belonged 10 to the United Kingdom.

Determined was this number by three international organizations: the Organisation for Economic Co-operation and Development (OECD), the Financial Action Task Force on Money Laundering (FATF) and the Financial Stability Board (FSB).

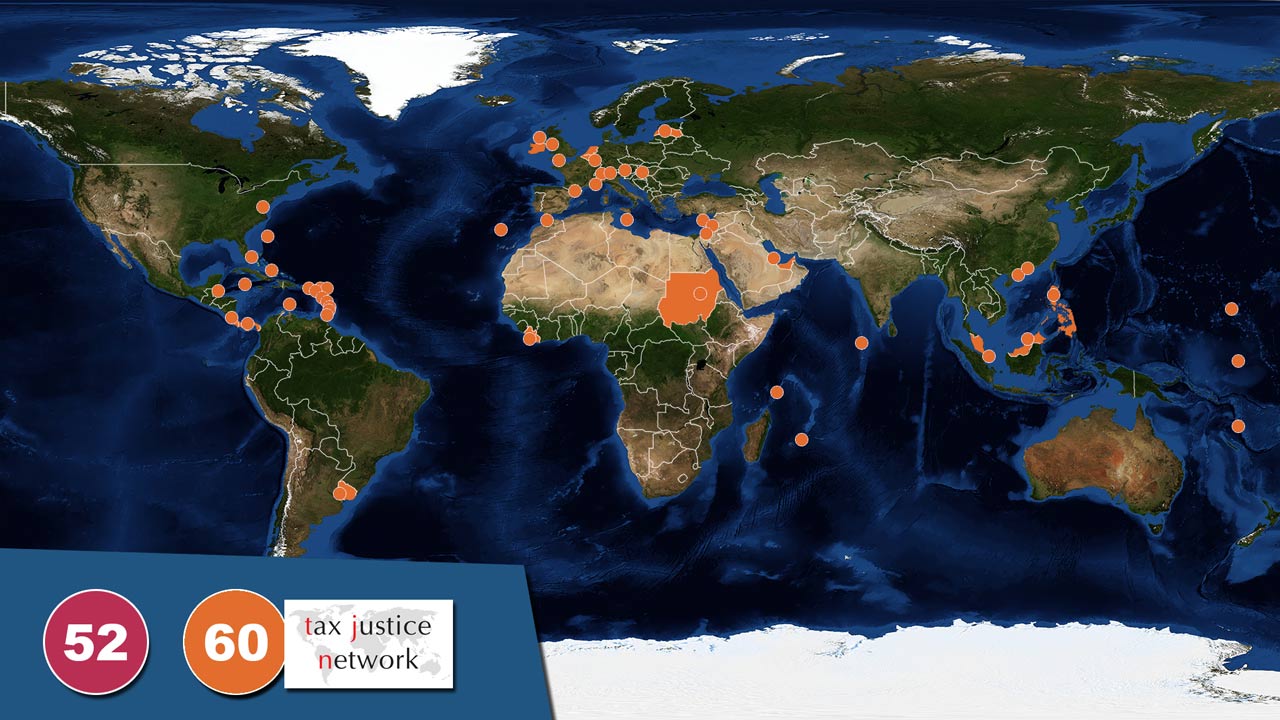

The composition of the list is imprecise and fluctuates. So determines the Independent Organization “Tax Justice Network” another number, because the organizations use different criteria to define tax havens.

What are the properties of tax havens?

- Unrestricted capital flows between countries.

- Strict or absolute bank secrecy.

- Fast and unbureaucratic formation of new enterprises.

- Tax exemptions for foreign companies and persons.

But it’s not so easy to become a tax haven. A tax haven needs great economic and political stability, and should not have the reputation to enable money laundering.

When began tax evasion?

This method isn’t new. People tried to avoid fiscal and trade rules for a long time.

But this trend accelerated after the Second World War when many colonies became independent. Because many of the colonies were only transit areas for trade purposes and weren’t used for production or cultivation. So were some of the Caribbean Islands only used for the Atlantic Triangular Trade.

After the colonies became independent stopped their former mother countries their financial and political support. Many of the newly formed countries could choose then between tourism and financial business. Most of them chose both.

Tax havens are particularly attractive because they offer a large field of financial products and banking services, which attracts private persons, companies, and organized crime.

What do tax havens offer?

Firstly private persons can choose tax havens as their main residence, then they don’t have to pay legacy tax and only small taxes on capital.

This may be morally wrong, but legal by avoiding laws. Equally to the number of millionaires continues the number of tax avoiders to increase.

From 4.7 million people with an income higher than a million dollar in the year 1996, increased the number to 12 million people in the year 2013.

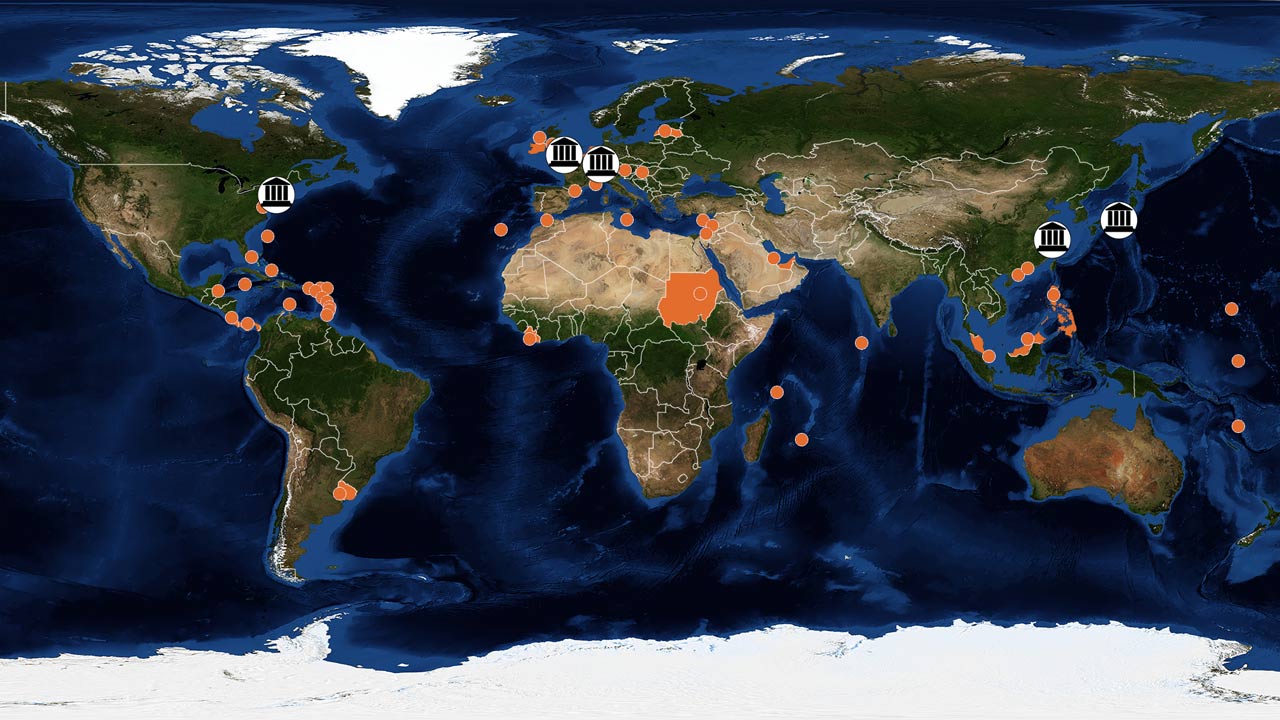

Secondly use large companies the same benefits. So have the 50 biggest companies in Europe subsidiary companies in fiscal paradises in Europe and the rest of the world. They can decrease their tax by moving profits to their subsidiary companies in low tax countries.

Thirdly attract tax havens the organized crime, which invest their money from illegal activities in offshore havens.

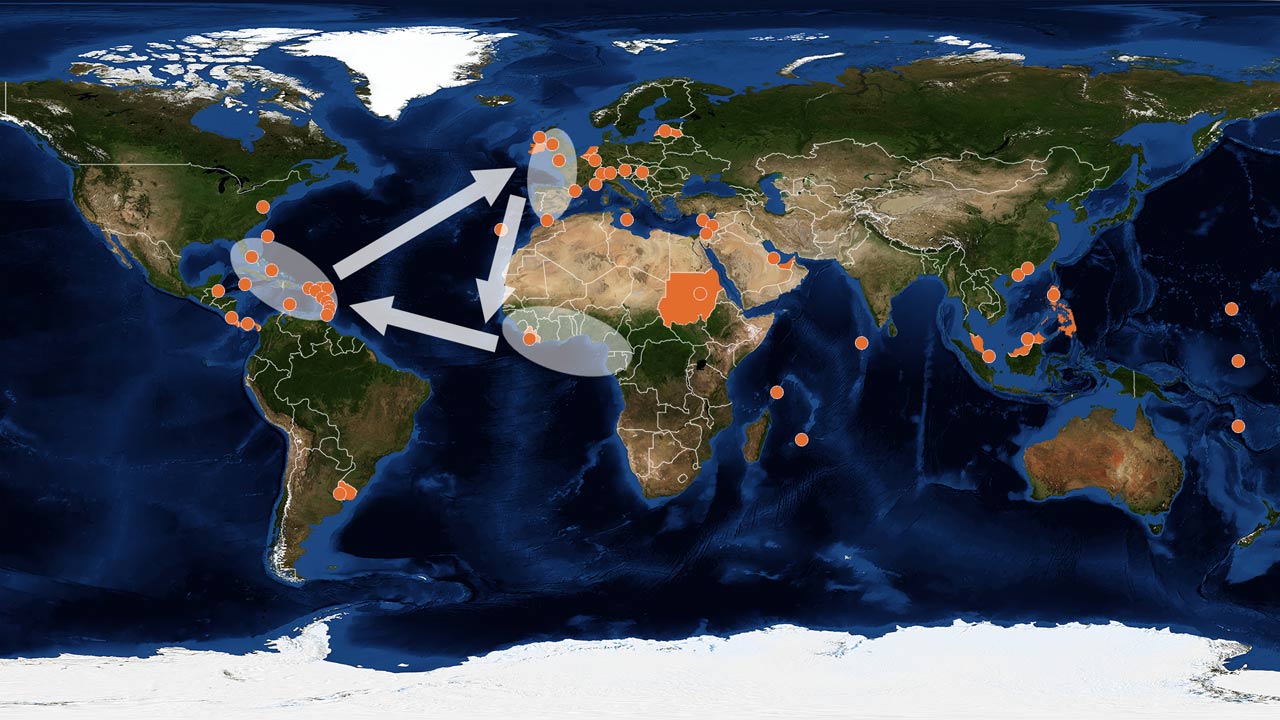

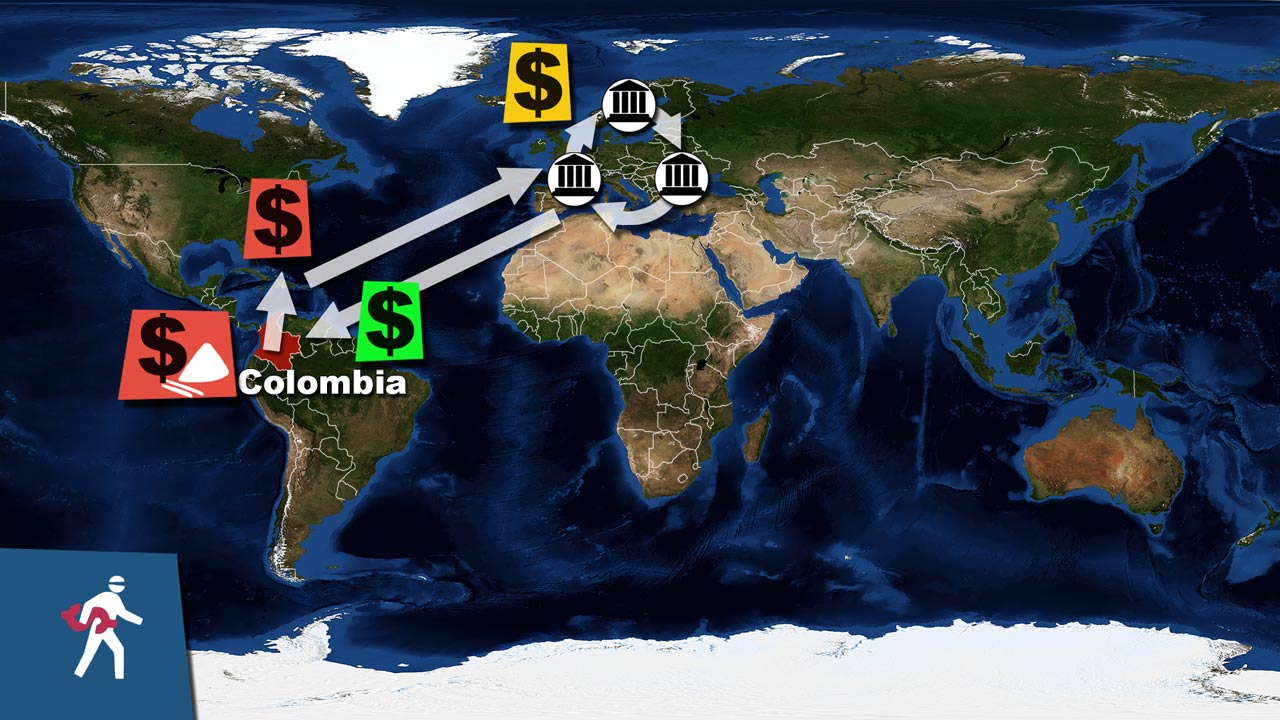

The circle of money laundering looks like this:

- Money of the Colombian Drug Trade moves to bank accounts at Caribbean tax havens.

- From there gets the money to the legal, financial system, for instance to Europe.

- In Europe circulates the money between different countries and bank accounts.

- And finally it gets back to Colombia, invested by European companies, which are controlled by the Colombian drug cartels.

As you can see is the method of money laundering well known, but the real amount of laundered money is hard to ascertain.